Nj Worksheet B 2019 . This bulletin explains the new jersey income tax rules that apply when you contribute money to or withdraw money from a traditional ira or roth ira. Printable new jersey state tax forms for the 2020 tax year will be based on income earned between january 1, 2020 through december 31, 2020.

How Much Child Support Will I Pay In New Jersey? from andrewfischerlaw.com

To access this feature you will need to validate that you did so by providing the new jersey gross income amount from your prior. Note that if you have too much tax withheld, you will receive a refund when you file your tax return. Fill in if the address above is a foreign address.

How Much Child Support Will I Pay In New Jersey?

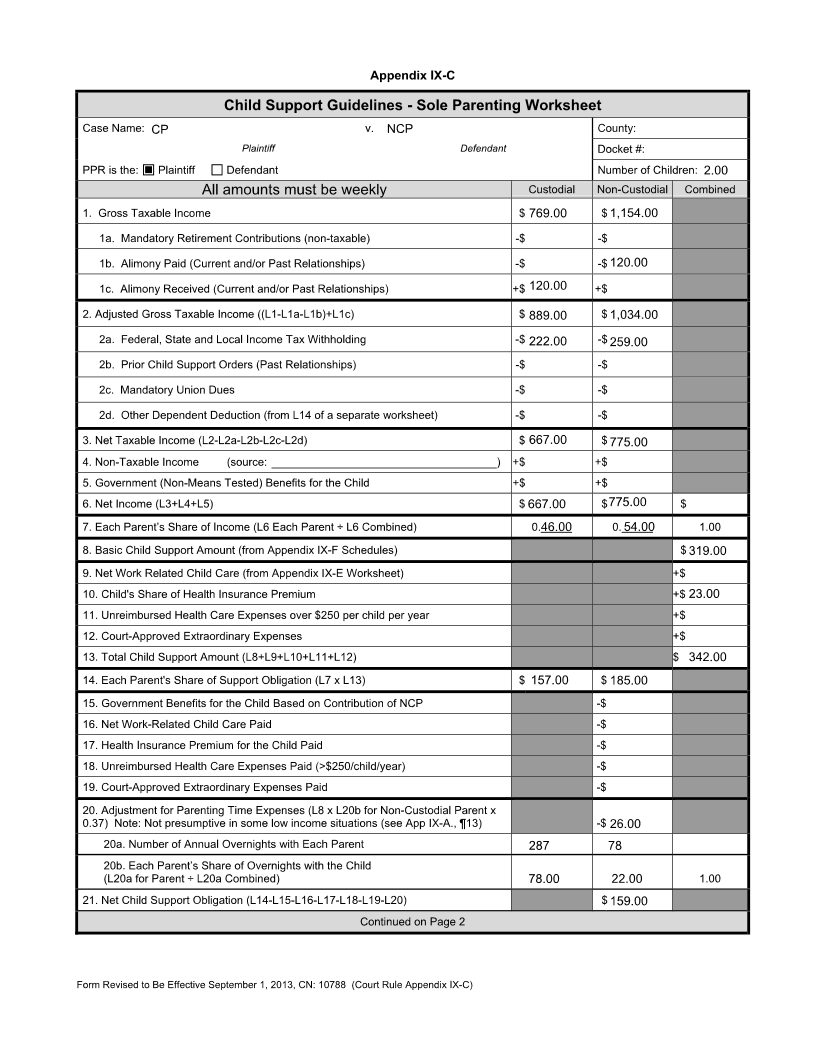

Gross income tax depreciation adjustment worksheet. Use this worksheet when (a) parents share custody of all the children for whom support is being determined, or (b) when one parent has primary physical custody of one or more of the children and the parents share custody of another child. It i also describes the income exclusions qualified taxpayers can use to reduce their new jersey taxable income. Schedule nj coj download fillable pdf or fill online credit for income or wage taxes paid to other jurisdiction 2019 new jersey templateroller.

Source: worksheetnow.info

Check Details

Use this worksheet when (a) parents share custody of all the children for whom support is being determined, or (b) when one parent has primary physical custody of one or more of the children and the parents share custody of another child. To access this feature you will need to validate that you did so by providing the new jersey.

Source: www.hawtcelebs.com

Check Details

Any contributions to this account for 2016 made in 2017. The current tax year is 2021, and most states will release updated tax forms between january and april of 2022. If you are eligible for a property tax benefit, you must complete worksheet i on page 34 to determine whether you. The program expects to issue only construction loans in.

Source: kleveritalia.com

Check Details

Use this worksheet when (a) parents share custody of all the children for whom support is being determined, or (b) when one parent has primary physical custody of one or more of the children and the parents share custody of another child. The state income tax table can be found inside the new jersey 1040 instructions booklet. Child support order.

Source: www.templateroller.com

Check Details

Printable new jersey state tax forms for the 2020 tax year will be based on income earned between january 1, 2020 through december 31, 2020. Enter result here and on line 35. Fill in if your address has changed. Any contributions to this account for 2016 made in 2017. If you have too little tax withheld, you will owe tax.

Source: exploreworksheet.com

Check Details

Use this worksheet when (a) parents share custody of all the children for whom support is being determined, or (b) when one parent has primary physical custody of one or more of the children and the parents share custody of another child. New jersey corporation business tax prior net operating loss conversion worksheet use this worksheet to calculate the converted.

Source: sairaa.org

Check Details

Gross income tax depreciation adjustment worksheet. Note that if you have too much tax withheld, you will receive a refund when you file your tax return. Worksheets used in this bulletin. To illustrate return completion are for tax year 2018 only. The current tax year is 2021, and most states will release updated tax forms between january and april of.

Source: db-excel.com

Check Details

It i also describes the income exclusions qualified taxpayers can use to reduce their new jersey taxable income. Please be sure to replace the default values presented here with your own values before you calculate! To illustrate return completion are for tax year 2018 only. Gross income tax depreciation adjustment worksheet. New jersey corporation business tax prior net operating loss.

Source: www.templateroller.com

Check Details

Please be sure to replace the default values presented here with your own values before you calculate! The current tax year is 2021, and most states will release updated tax forms between january and april of 2022. This amount cannot exceed your new jersey tax on line 41. Filers with multiple jobs or working New jersey has a state income.

Source: jojoworksheet.com

Check Details

If you have too little tax withheld, you will owe tax when you file your tax return, and you might owe a penalty. To access this feature you will need to validate that you did so by providing the new jersey gross income amount from your prior. Any contributions to this account for 2016 made in 2017. Although it is.

Source: sairaa.org

Check Details

This amount cannot exceed your new jersey tax on line 41. To access this feature you will need to validate that you did so by providing the new jersey gross income amount from your prior. Printable new jersey state tax forms for the 2020 tax year will be based on income earned between january 1, 2020 through december 31, 2020..

Source: kleveritalia.com

Check Details

To access this feature you will need to validate that you did so by providing the new jersey gross income amount from your prior. If you are eligible for a property tax benefit, you must complete worksheet i on page 34 to determine whether you. Schedule nj coj download fillable pdf or fill online credit for income or wage taxes.

Source: www.pinterest.com

Check Details

If you are eligible for a property tax benefit, you must complete worksheet i on page 34 to determine whether you. Fill in if your address has changed. New jersey has a state income tax that ranges between 1.4% and 10.75%, which is administered by the new jersey division of revenue.taxformfinder provides printable pdf copies of 96 current new jersey.

Source: www.pdffiller.com

Check Details

For determining the new jersey income reportable in each of the income If you have too little tax withheld, you will owe tax when you file your tax return, and you might owe a penalty. Schedule nj coj download fillable pdf or fill online credit for income or wage taxes paid to other jurisdiction 2019 new jersey templateroller. Use this.

Source: www.irs.gov

Check Details

New jersey corporation business tax prior net operating loss conversion worksheet use this worksheet to calculate the converted prior net operating losses for use for tax years ending on and after july 31, 2019. Although it is late in the year, if you were disappointed in the size of your refund or you had an unexpected balance due when you.

Source: schedule-b-1-form-1065.com

Check Details

Total value of this account (add lines 1a and 1b. For determining the new jersey income reportable in each of the income A new jersey hybrid corporation is a federal s corporation that has not elected to be treated as an s corporation for new jersey purposes and conducts business both within and outside new jersey. Enter result here and.

Source: 1044form.com

Check Details

Gross income tax depreciation adjustment worksheet. This amount cannot exceed your new jersey tax on line 41. A new jersey hybrid corporation is a federal s corporation that has not elected to be treated as an s corporation for new jersey purposes and conducts business both within and outside new jersey. Use this worksheet when (a) parents share custody of.

Source: www.hawtcelebs.com

Check Details

The state income tax table can be found inside the new jersey 1040 instructions booklet. Worksheets used in this bulletin. Use this worksheet when (a) parents share custody of all the children for whom support is being determined, or (b) when one parent has primary physical custody of one or more of the children and the parents share custody of.

Source: www.incometaxpro.net

Check Details

If an underpayment does exist for any column in part i, you should complete part ii, exceptions, and the appropriate worksheet on page To access this feature you will need to validate that you did so by providing the new jersey gross income amount from your prior. Total value of this account (add lines 1a and 1b. The current tax.

Source: andrewfischerlaw.com

Check Details

New jersey corporation business tax prior net operating loss conversion worksheet use this worksheet to calculate the converted prior net operating losses for use for tax years ending on and after july 31, 2019. For determining the new jersey income reportable in each of the income Any contributions to this account for 2016 made in 2017. This bulletin explains the.

Source: homeschooldressage.com

Check Details

Printable new jersey state tax forms for the 2020 tax year will be based on income earned between january 1, 2020 through december 31, 2020. This bulletin explains how to report pension and annuity income on your new jersey ncome tax return. It i also describes the income exclusions qualified taxpayers can use to reduce their new jersey taxable income..